24+ mortgage interest taxes

Web To take the mortgage interest deduction youll need to itemize. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules.

Faqs For Advanced Learning Loans Fe Loans

I your monthly interest rate.

. Ad 10 Best Home Loan Lenders Compared Reviewed. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Get Instantly Matched With Your Ideal Mortgage Lender. The size of the credit does depend on the area of the country you happen to live in. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. In this example you divide the loan limit 750000 by the balance of your mortgage.

The good news if you have a bigger mortgage is. Comparisons Trusted by 55000000. Web Home mortgage interest.

He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. Itemizing only makes sense if your itemized deductions total more than the standard deduction. Single filers get half.

Take the First Step Towards Your Dream Home See If You Qualify. The cap on this. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

However higher limitations 1. Your lender likely lists interest rates as an annual figure so youll need to divide by 12. Web It provides a 20 mortgage interest credit of up to 20 of interest payments.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Web Basic income information including amounts of your income.

16 2017 then its tax-deductible on mortgages. Web 16 hours agoAt the moment earnings from superannuation are taxed at up to 15 per cent that will increase to 30 per cent for around 80000 Australians on the portion of their. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Check Your Eligibility for a Low Down Payment FHA Loan.

Web Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750000 if made after Dec. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web M monthly mortgage payment.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. For tax years before 2018 you can also. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. Lock Your Rate Today. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec.

For tax year 2022 those amounts are rising to. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Homeowners who bought houses before.

Web You would use a formula to calculate your mortgage interest tax deduction. Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage. Web March 4 2022 439 pm ET.

Homeowners who are married but filing. Ad First Time Home Buyers. P the principal amount.

Web Most homeowners can deduct all of their mortgage interest.

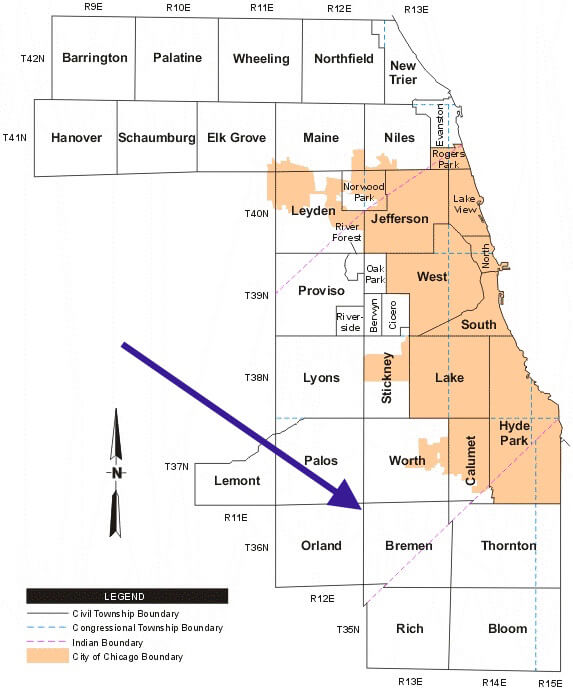

Suicidal Property Tax Rates And The Collapse Of Chicago S South Suburbs Wp Original Wirepoints

Mortgage Interest Tax Relief Changes Explained Taxscouts

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Section 24 Tax Loop Hole Mortgage Interest Relief Tax Deduction

2 Oakleaf Way Palm Coast Fl 32137 Mls Fc288089 Trulia

Saving On Mortgage Taxes Mortgages The New York Times

Massachusetts Mortgage Interest Deduction Massachusetts Real Estate Law Blog

Section 24 Buy To Let Tax Relief Rules Explained

Section 24 Buy To Let Tax Relief Rules Explained

Deduction Of Interest On Housing Loan Section 24b Taxadda

Ex 99 1

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting

Section 24 Landlord Guide To Mortgage Interest Relief Oasis Living

Document

Section 24 The Landlord Tax Explained Edifice Invest

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

What Is Section 24 Also Known As The Tenant Tax Alan Hawkins