Commission payroll tax calculator

For the past couple of decades however FICA tax rates have remained consistent. Fast easy accurate payroll and tax so you save time and money.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

You can calculator your commission by multiplying the sale amount by the commission percentage.

. For more information see WA Department of Finance. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Super contribution caps 2021 - 2022 - 2023.

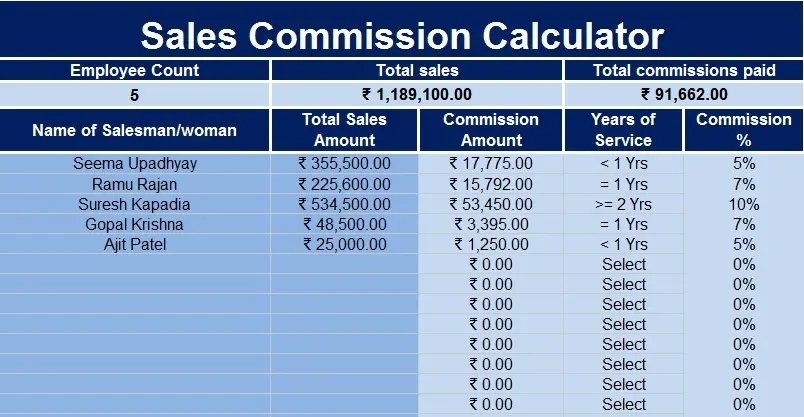

Our calculator will take between 2 and 10 minutes to use. Employee years of service less than 1 year then he is eligible for 5 commission. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

When you start a new job and fill out a. The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Payroll Tax Definition.

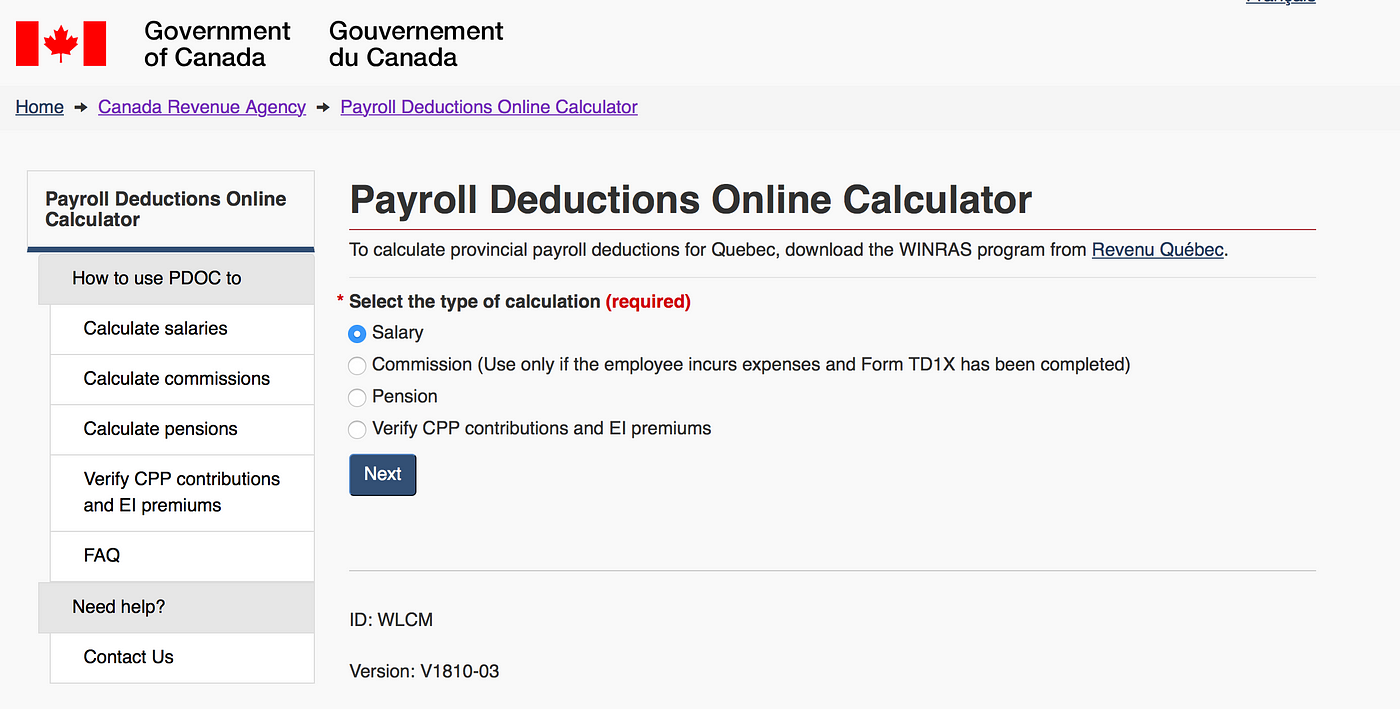

The tool then asks you to enter the employees province of residence and pay frequency weekly biweekly monthly etc. Estimate your provincial taxes with our free British Columbia income tax calculator. Finally the payroll calculator requires you to input your employees tax information including any entitled credits along with year-to-date Canada Pension Plan CPP and Employment Insurance EI contributions.

Deductions like income tax or health benefits can be calculated by subtracting their percentage from gross earnings. To calculate the amount of tax to deduct you can use the Payroll Deductions Online Calculator. A Heading Section and.

Rates are up to date as of June 22 2021. Employees who earn commissions with expenses. Luckily our payroll tax calculator is here to lessen the burden of calculating payroll taxes so they almost seem free.

Simply input wage and W-4 information for each employee and our handy calculator will spit out gross pay net pay. If it is equal to 1 year then 7 and if the years of service are moe than or equal to 2 years the employee is eligible for 10 commission. The general payroll tax rate in Victoria is currently since 1 July 2014 is 485 eligible regional employers 2425 progressively reducing to 12125 by 2022-23.

Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out a Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions in addition to Form TD1. If you use such a link to make a purchase this site may be paid a small commission. Employers and employees split the tax.

These calculations are approximate and include the following non-refundable tax credits. It also automates payroll includes an employee self-service portal and offers some human resources HR tools. Study and training support loan contributions.

Gusto has a free employer tax calculator which provides an accurate estimate of how much youll have to pay in payroll taxes over a year. In other words if you make a sale for 200 and your commission is 3 your commission would be 200 03 6. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

Tax rates 2022-23 calculator. What the tax withheld for individuals calculator does. Additional Oklahoma Payroll Tax Resources.

Medicare tax rates rose from 035 in 1966 when they were first implemented to 135 in 1985. If your health insurance premiums and retirement savings are deducted from your paycheck automatically then those deductions combined with payroll taxes can result in paychecks well below what you would get otherwise. Payroll taxes are part of the reason your take-home pay is different from your salary.

Oklahoma Tax Commission 405 521-3160 New Business Information Business Tax Forms. Trade business commission-based business or any other business where your income remuneration is dependent upon the services and products you. See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed.

After-tax income is your total income net of federal tax provincial tax and payroll tax. Tax rates 2021-22 calculator. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively.

B Data Input. Guide RC4110 Employee or Self-employed. The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount.

Form TD1-IN Determination of Exemption of an Indians Employment Income. For example if you have gross earnings of 550 in column A1 and the income tax that must be deducted is 12 you can enter A1012 in the cell that you would like the deduction to appear in. Take a look now and thank us later.

Payroll Tax Rate in Victoria. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. The tax withheld for individuals calculator can help you work out the tax you need to withhold from payments you make to employees and other workers and takes into account.

Exempt means the employee does not receive overtime pay. Net medical expenses tax offset calculator This calculator will help you work out the amount of medical expenses offset you can claim for the 2015-16 to 2018-19 income years. Then enter the employees gross salary amount.

Payroll Tax Western Australia This is general information and not advice. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

01 Jul 2021 QC 16851. Oklahoma Employment Security Commission 405 557-7222 Business Resources Filing Employer Taxes Online. Here are a few additional resources that we think will help you.

It regularly tops lists of the best payroll software for small businesses. From 1 July 2017 a payroll tax rate of 365 2425 from 1 July 2018 is for businesses with a payroll of 85 regional employeesThis further. Guide RC4157 Deducting Income Tax on Pension and Other Income and Filing the T4A Slip and Summary.

Sales Commission Calculator consists of tow sections.

How To Calculate Payroll Taxes In 5 Steps

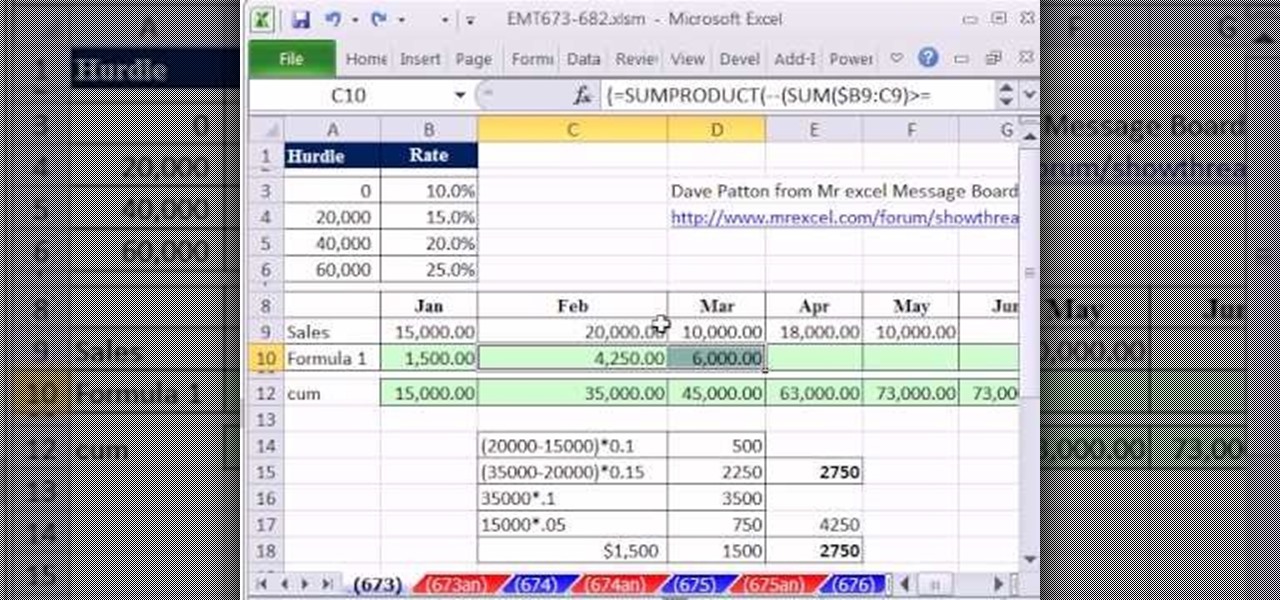

How To Calculate Commission Based On Varying Rates In Excel Microsoft Office Wonderhowto

How To Calculate Commission Of Different Types Traqq

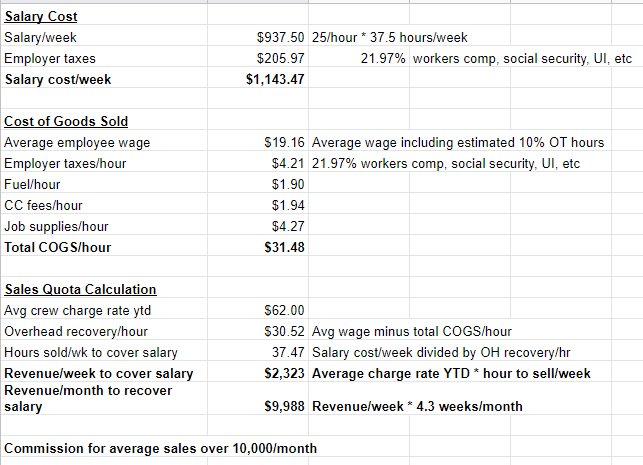

4 Free Sales Commission Spreadsheets Templates Sales Commissions Explained

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Take Home Pay Calculator

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Payroll Formula Step By Step Calculation With Examples

Paycheck Calculator Take Home Pay Calculator

Download Sales Commission Calculator Excel Template Exceldatapro

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Calculate Tax Amounts

Sales Person Commission Calculator Ready Business Systems

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

4 Free Sales Commission Spreadsheets Templates Sales Commissions Explained

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto